Markets

Visualizing the World’s Busiest Ports

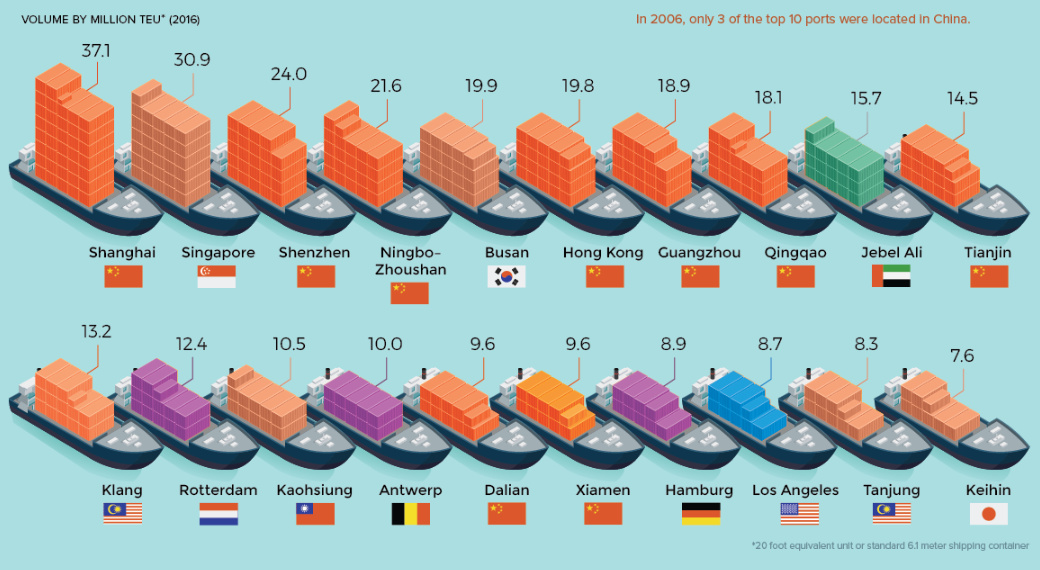

The World’s Busiest Ports

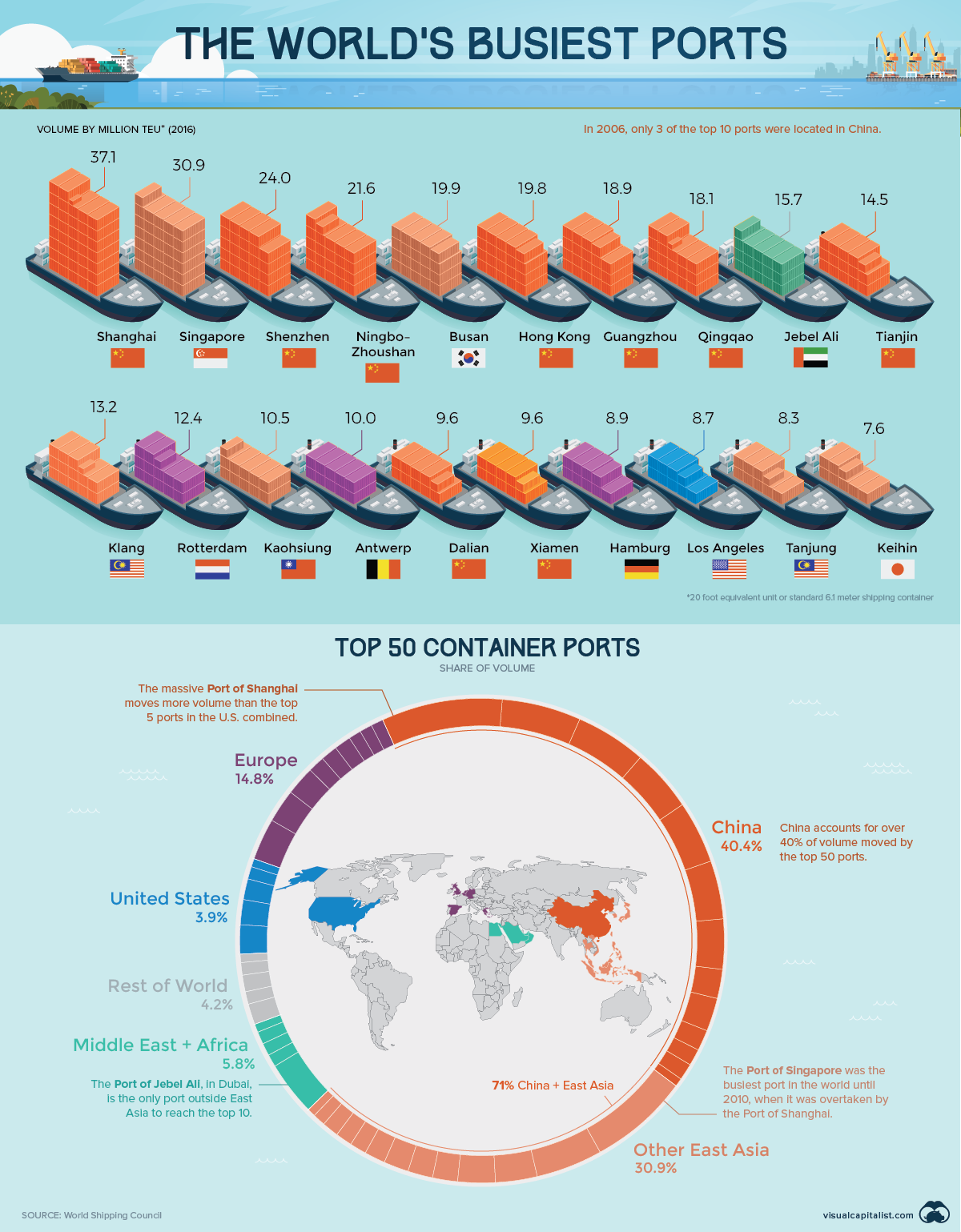

An estimated 90% of world trade is facilitated by maritime shipping, and as trade volumes continue to increase, the world’s busiest ports continue to grow larger and more efficient to meet demand.

In fact, in just the last four years, the median annual volume of the top 50 ports jumped from 5.49 to 5.86 million twenty-foot equivalent units (TEUs).

Here are the world’s 20 largest ports, using the most recent data from the World Shipping Council:

| Rank | Port Name | Country | 2016 Volume | 2012 Volume | 4-Year Change |

|---|---|---|---|---|---|

| 1 | Shanghai | 🇨🇳 China | 37.1 | 32.5 | +14% |

| 2 | Singapore | 🇸🇬 Singapore | 30.9 | 31.7 | -2% |

| 3 | Shenzhen | 🇨🇳 China | 24.0 | 22.9 | +5% |

| 4 | Ningbo-Zhoushan | 🇨🇳 China | 21.6 | 16.8 | +28% |

| 5 | Busan | 🇰🇷 S. Korea | 19.9 | 17.0 | +17% |

| 6 | Hong Kong | 🇭🇰 China | 19.8 | 23.1 | -14% |

| 7 | Guangzhou Harbor | 🇨🇳 China | 18.9 | 14.7 | +28% |

| 8 | Qingdao | 🇨🇳 China | 18.0 | 14.5 | +24% |

| 9 | Jebel Ali | 🇦🇪 U.A.E. | 15.7 | 13.3 | +18% |

| 10 | Tianjin | 🇨🇳 China | 14.5 | 12.3 | +18% |

| 11 | Port Klang | 🇲🇾 Malaysia | 13.2 | 10.0 | +32% |

| 12 | Rotterdam | 🇳🇱 Netherlands | 12.4 | 11.9 | +4% |

| 13 | Kaohsiung | 🇹🇼 Taiwan | 10.5 | 9.8 | +7% |

| 14 | Antwerp | 🇧🇪 Belgium | 10.0 | 8.6 | +16% |

| 15 | Dalian | 🇨🇳 China | 9.6 | 8.9 | +8% |

| 16 | Xiamen | 🇨🇳 China | 9.6 | 7.2 | +34% |

| 17 | Hamburg | 🇩🇪 Germany | 8.91 | 8.89 | 0% |

| 18 | Los Angeles | 🇺🇸 U.S.A. | 8.9 | 8.1 | +10% |

| 19 | Tanjung Pelepas | 🇲🇾 Malaysia | 8.3 | 7.7 | +8% |

| 20 | Keihin | 🇯🇵 Japan | 7.6 | 7.9 | -3% |

Volume is measured in millions of TEUs

Only five of the top 20 ports in the world are now located outside of East Asia. The Port of Los Angeles is the only U.S. entrant in the top 20, and only three European ports made the cut.

Today, trade is more likely than ever to flow through the South China Sea.

Ruling the High Seas

From dollar store knick-knacks to nuclear reactor components, China’s manufacturing output is a critical link in the global supply chain. Getting all those products to consumers and companies around the world is big business, and over the past decade, China has emerged as the heavyweight champion of world shipping.

While Danish company, Maersk, is still the largest shipping line, an ever increasing share of the world’s container traffic is moving through Chinese controlled ports. An estimated two-thirds of container traffic now passes through Chinese ports or ports that have received Chinese investment.

New Kids on the Block

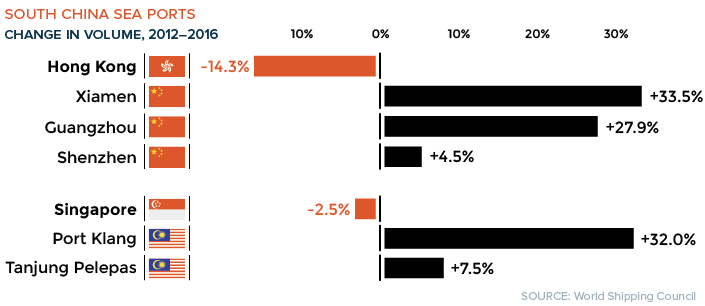

While shipping volumes on a global basis continue to rise, not all of that growth has been spread around equally. This is particularly true for established titans of the South China Sea.

At the outset of this millennium, Hong Kong and Singapore were home to the busiest ports in the world. Today, both are facing increased competition from neighboring ports, as well as declining volumes:

In contrast, the massive Port of Shanghai saw a 71% increase over the last decade, and many other Chinese ports has seen significant growth in volume in recent years.

If China’s One Belt One Road initiatives and investments in global port facilities are any indication, the country’s domination of maritime shipping will only continue to strengthen in the near term.

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

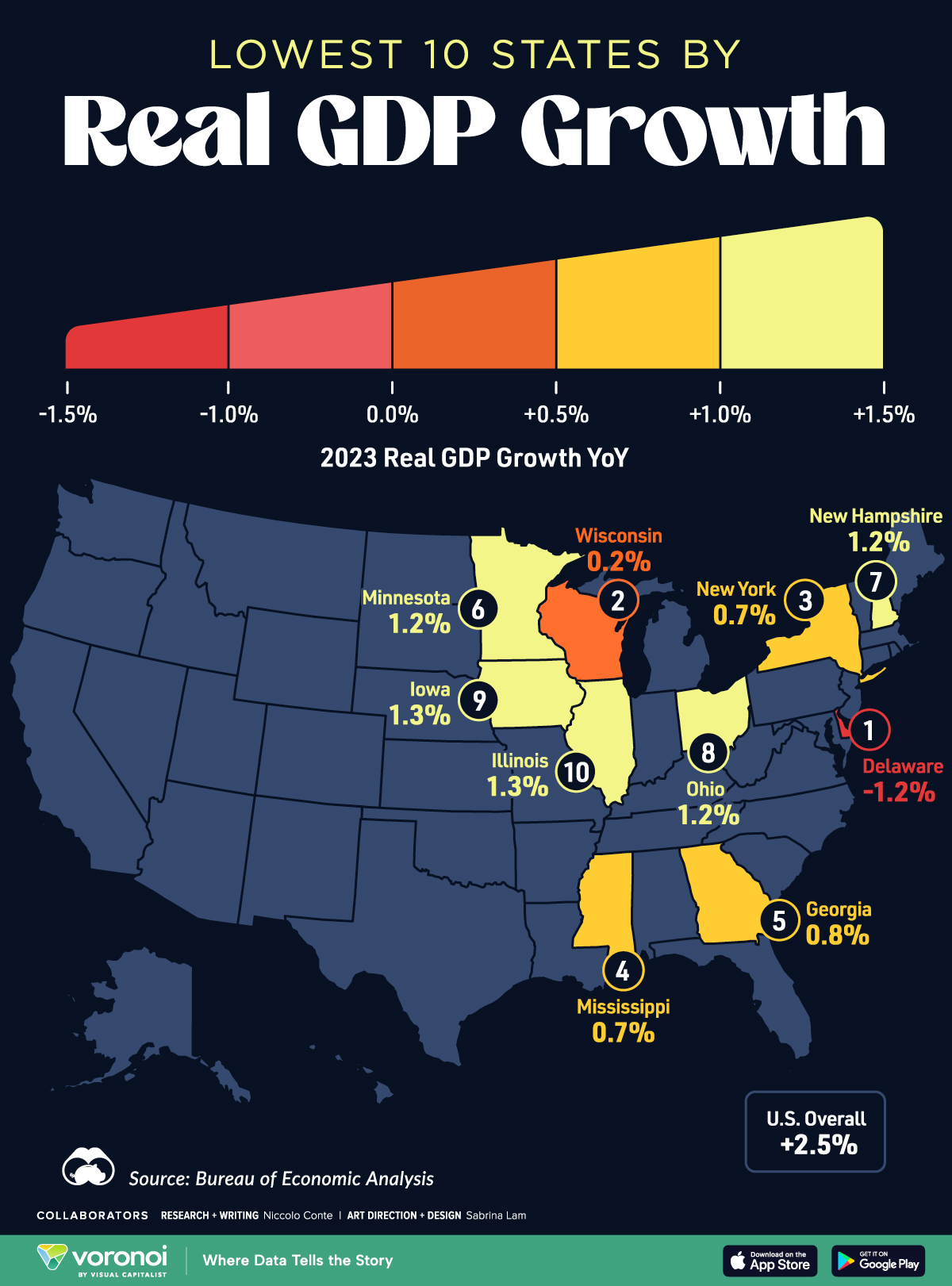

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

United States7 days ago

United States7 days agoMapped: Countries Where Recreational Cannabis is Legal

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Money2 weeks ago

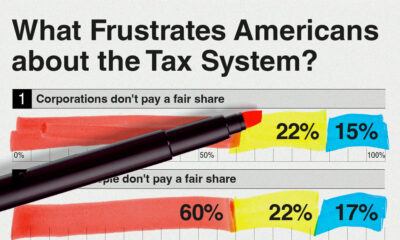

Money2 weeks agoCharted: What Frustrates Americans About the Tax System

-

Technology2 weeks ago

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

-

Mining2 weeks ago

Mining2 weeks agoWhere the World’s Aluminum is Smelted, by Country

-

Personal Finance2 weeks ago

Personal Finance2 weeks agoVisualizing the Tax Burden of Every U.S. State